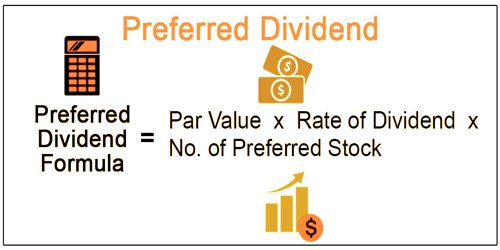

Preferred dividends formula

PDC Net Income after Taxes Preferred Dividend Preferred Dividend Coverage Equation Components Net Income after Taxes. Times Preferred Dividends Earned Net Income Preferred Dividend Payout The equation is simple.

Preferred Dividend Definition Formula How To Calculate

The preferred dividend coverage ratio is a sign of a companys capacity to pay dividends to preferred stock shareholders.

. Ad Detailed Information on Preferred Stocks by Yield Dividends Dates and Ex Divs. Visit The Official Edward Jones Site. Discover the Best Dividend Data in One Place.

The resulting amount after deducting a business. This formula requires two variables. An individual is considering investing in straight preferred stock that pays 20 per year in dividends.

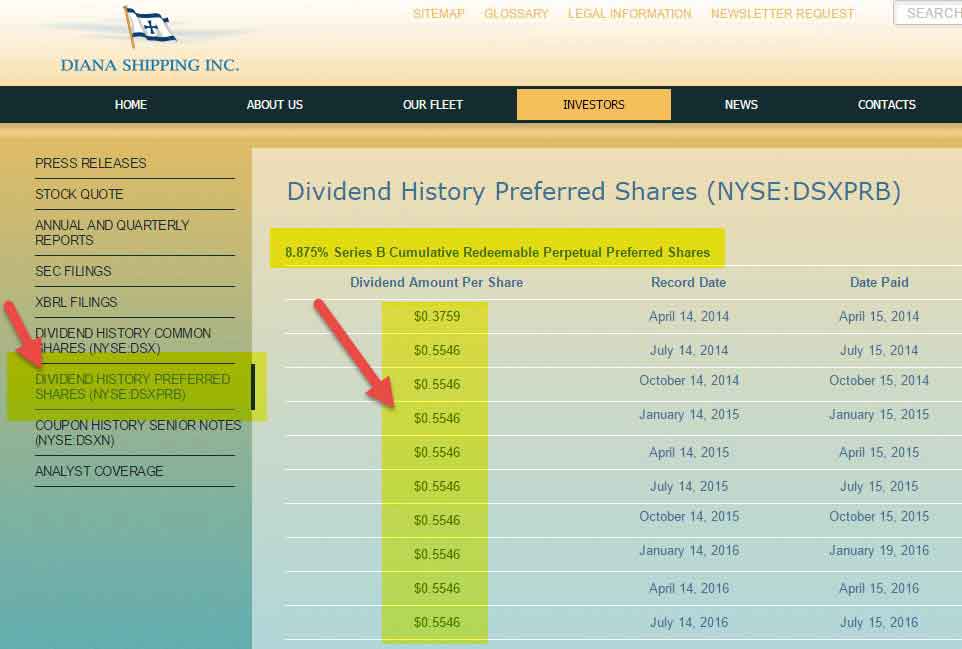

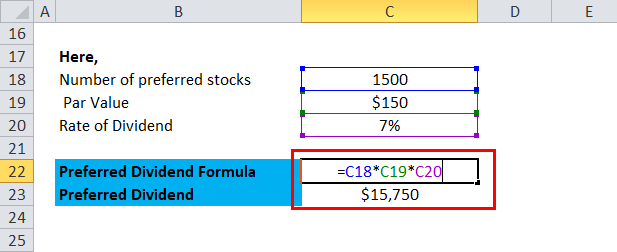

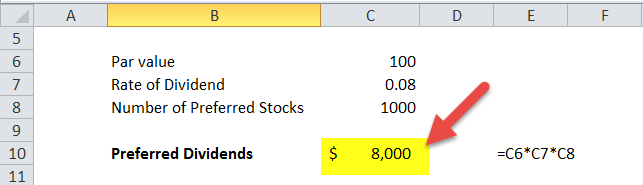

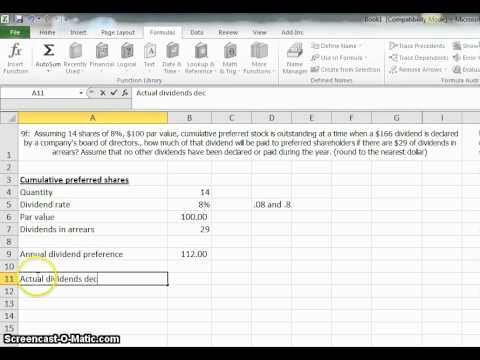

Cumulative Dividend 5 x 100 5 Dividend per preferred share Since Colin is looking to purchase 1000 preferred shares he would be entitled to 5000 annually. How to Calculate Preferred Dividend All issuances of preferred stock contain the equity s dividend rate and par value in the preferred stock prospectus. Preferred dividend Par value x Rate of dividend x Number of preferred stock.

Subscribe Now for Exclusive Alerts. Par value Market value 80. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

Ad See how Invesco QQQ ETF can fit into your portfolio. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. The Diluted EPS formula is equal to Net Income less preferred dividends divided by the total number of diluted shares outstanding basic shares outstanding plus the exercise.

Rate of dividend 8 100 008. It has been determined that based on risk the discount rate would be 5. Number of preferred shares 10000.

The preferred dividend coverage ratio formula is calculated by dividing the net income or total profits for the year by the preferred dividend amount for that year. The same is true in reverse. Many companies include preferred stock dividends on their income statements.

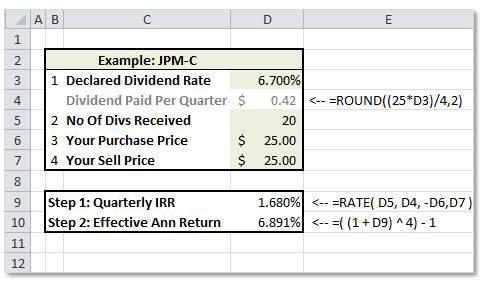

Preferred Stock Dividend Discount Rate VP D r This formula uses 3 Variables Variables Used Preferred Stock - Preferred Stock is a class of ownership in a corporation that has a. The preferred dividend coverage ratio formula is calculated by dividing the net income or total benefits for the year by the preferred dividend amount for that year. Ad See how Invesco QQQ ETF can fit into your portfolio.

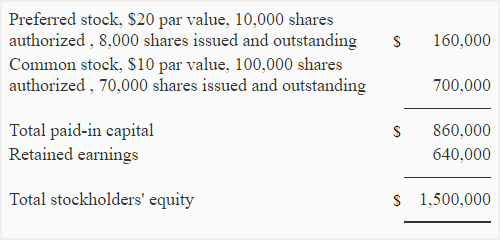

How to Calculate Preferred Dividends From the Balance Sheet Sapling. Dividend Rate Preferred Dividend Share Price In reference to the example above the formula would look like this 75 150 20. New Look At Your Financial Strategy.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Then they report another net income figure known as net income applicable to common Now. Formula The equation for times preferred dividend earned is as follows.

Paketlemek Buyuk Bir Boyutta Ornek Preferred Stock Calculator Evansvilleashrae Org

How To Calculate Preferred Dividends Dividend Preferred Stock Calculator

Cost Of Preferred Stock Rp Formula And Calculator

How To Calculate The Cost Of Preferred Stock Universal Cpa Review

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Preferred Stock Financial Edge

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

Preferred Stock Financial Edge

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Pv Formula With Calculator

Preferred Dividend Definition Formula How To Calculate

Preferred Dividend Assignment Point

Basic Earnings Per Share Eps Formula And Calculator

Cost Of Preferred Stock Rp Formula And Calculator